From

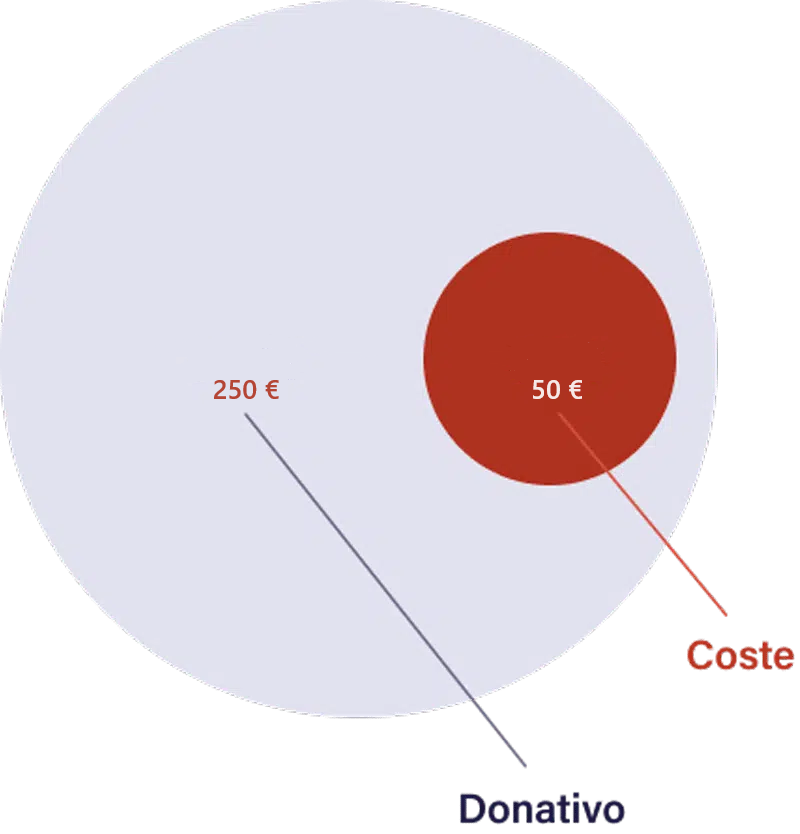

here you can access the document that analyzes the tax regime for the

donations, in-kind donations and contributions made to foundations to which Royal Decree-Law 17/2020 of May 5 published in the Official State Gazette of May 6, 2020 is applicable, which includes an amendment to Article 19 of Law 49/2002.