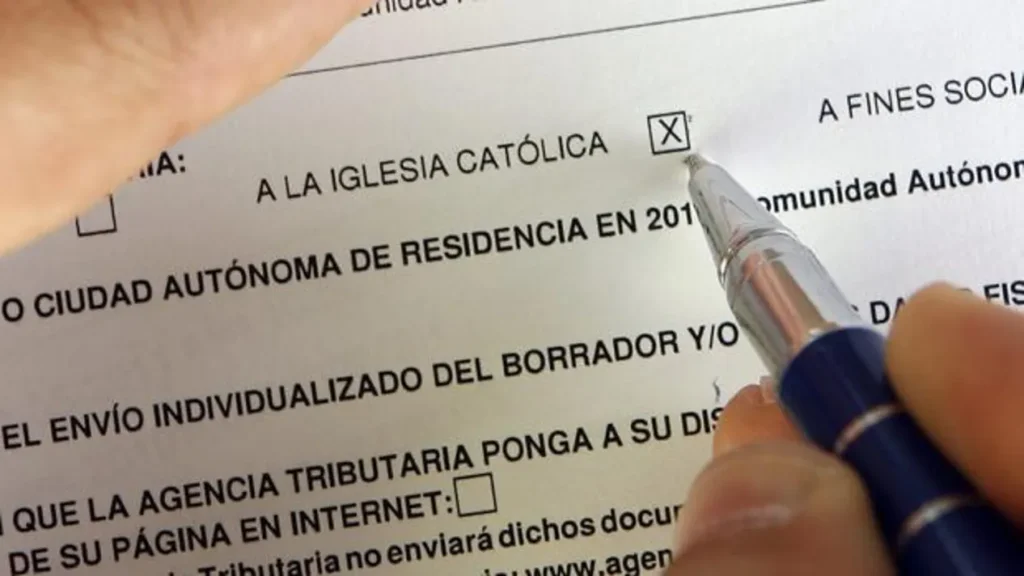

When you make your income tax returnYou have the option of marking the X (box 105) to allocate 0.7 % of your full tax liability to the financial support of the Catholic Church. This choice does not imply higher tax payments nor does it reduce the refund you may receive. In addition, it is compatible with box 106, intended for activities of social interest, allowing you to allocate an additional 0.7 % to social projects at no additional cost to you.

In the Renta 2024 campaign, corresponding to the 2023 tax year, 208,841 more declarations were registered in favor of the Catholic Church compared to the previous year. This represents a significant increase in taxpayer support.

The total amount allocated to the Church reached 382,437,998 euros, an increase of 23.6 million euros over the previous year. The average contribution per taxpayer who checked the box was 42.5 euros.

The box 105The "Tax Allocation to the Catholic Church", is located in the "Tax Allocation to the Catholic Church" section of the page 1 of the Model 100 on your income tax return. If you wish to contribute to the support of the Church, you must check this box. Remember that you can also simultaneously check box 106 to support activities of social interest.

In addition to the tax allowance, you can collaborate with the Church through donations, which are tax deductible according to Law 49/2002 on Patronage. For example, donations of up to 250 euros have a deduction of 80 %, which means that the Treasury will give you 200 euros back on your income tax return. This tax incentive makes it easier to support the work of the Church and its institutions.

It is the voluntary option to allocate a percentage of the full membership fee to collaborate with the economic support of the Catholic Church and/or other purposes of social interest.

Marking the X in the box for the Catholic Church in the income tax return does not mean that the taxpayer has to pay more or be refunded less and is fully compatible and independent of the allocation for other purposes of social interest. In both cases, 0.7 % of the total tax liability will be allocated to each option.

On the contrary, do not check any option. It will mean that 0.7 % of the total personal income tax liability will be imputed to the General State Budget for general purposes.

In any case, whatever your decision regarding the tax allocation, does not change the final amount of the tax you pay or the refund to which you are entitled. It does not affect your tax liability.You simply decide where you want a portion of your taxes to go.

Another to help the Church is by carrying out a recurring donation or punctual. Collaborating in this way with NGOs that support the work of the Catholic Church. These donations can be tax deductible in the tax return.

The tax deductibility of donations to NGOs is governed by the new Patronage Law 49/2002, which rewards private efforts in activities of general interest.

Thanks to the new Patronage Law, donations of up to 250 € will have an income tax deduction of 80 %. That is, by donating 20.83 €/month or 250 €/year, the Treasury will refund you 200 € in your income tax return.

For 20 € per month you can help us to our seminarians continue their formation and thus ensure that no vocation is lost.

Since 2007 the Church does not receive money from the General State Budget and renounces to the VAT exemption. That year the 1979 Agreement between Spain and the Holy See on economic matters was modified and the box 105 for the support of the Catholic Church was created.

The amount received from taxpayers who check the Catholic Church box on their income tax returns is distributed in solidarity from the Interdiocesan Common Fund.

This fund, which is made up of direct contributions from the faithful and taxpayers, is distributed among the different dioceses according to their size and needs. It accounts for an average of 25 % of the financing of the dioceses in Spain.

According to the latest available data, nearly 9 million people mark the "X" in favor of the Catholic Church in our country.

A gesture that the Church appreciates and encourages to continue doing so, in order to be able to continue with all the work it does for the benefit of society as a whole.

The Church in Spain relies on several sources of financing to sustain its activities. The main ones are:

The Church in an exercise of transparency, each year reports the amount of taxpayers' tax allocations received each yearand what has been the destination of this amount.

Once this amount is distributed, mainly to the dioceses, it becomes part of their diocesan economy. All this information is reflected each year in the Annual Report of activities of the EEC.

On the website of the Episcopal Conference, each year they report the amount received by checking the box for the Catholic Church on the income tax return.

It has as mission to bring the Church closer to society by promoting measures of transparency and good economic governance in the Episcopal Conference and its works, as well as in the rest of the entities that depend on it.

The amount from the tax allocation is sent to the 70 dioceses in Spain.. The dioceses integrate it into their diocesan budget to undertake the activities proper to the Church.

More than half of the the expenses of all Spanish dioceses were pastoral and welfare expensesThe cost of the buildings, together with building maintenance and operating expenses.

The Episcopal Conference annually requests information from the dioceses on their consolidated financial accounts, including the parishes, in order to provide transparency to the process and obtain information on the origin of their resources and the applications that have been given each year.

With the action of marking the "X" in the church box on the income tax, we contribute resources for the Church to continue carrying out activities that benefit the whole of Spanish society.

That is why the Church thanks all those Spaniards who contribute with this gesture and with the rest of the campaigns carried out throughout the year to support the religious, spiritual and social work at the service of millions of Spaniards.

This contribution is decisive in sustaining the immense work of the Church, which, in order to continue helping, needs more than ever the collaboration of everyone.

For all these reasons CARF encourages you to check the box for the Catholic Church. in this year's income tax return.